All posts are my own opinion and do not represent any organization I am affiliated with.

iPhone 7 Annoyances

Posted by: davidkircos in random 9 years, 1 month ago

I upgraded to the iPhone 7 a couple weeks ago after realizing that would only cost me sales tax + $1 extra per month. This was because they would reduce my bill by $20/month and finance the purchase of the new phone for $21/month. So I walked out of the store paying $21 (3% Colorado sales tax) and had a brand new $700 phone. I'm not sure why Verizon lowered my bill by $20/month, but I wasn't too eager to ask questions.

I really like the design of the iPhone 7, it is very consistent with very few asymmetries. Previous iPhones had those asymmetric antenna lines, on this one the antenna is invisible. There is, however, one major exception; the giant camera protruding out of the back. This prevents the phone from lying down flat on a flat surface, just like the iPhone 6. And just as annoying. In my opinion, it would have been much better to make the rest of the phone thicker and increase the battery size as well as keep the 3.5 headphone jack. Which brings me to the most annoying part of the iPhone 7.

The iPhone 7 headphones do not work with a Macbook. It's not possible, not even with a dongle. Owning a Mac and iPhone used to feel like being part of a metaphorical club where everything worked together really well. The new headphones are a pretty stark deviance from that seamless ecosystem. I really hope Apple figures these usability things out better in the future, it would be even more annoying to have to learn Android :p

Complaints aside, I still really like the iPhone. As of late it feels just a little bit like Apple has lost their way. Investors might be thinking that too, which could partially explain why APPL is trading at only 15 times earnings. Where almost every other major tech company is more than double that (Microsoft 30x, Google 30x, Facebook 45x, Amazon 170x, with the notable exception of Samsung at only 13x).

Haiku Monday

Posted by: davidkircos in fun, random 9 years, 2 months ago

1/2/2017

in the mountain sun

able to take a deep breath

calm before the fray

Monday's I am going to write poems. I will vary the poem type week to week. Next week I'm taking inspiration from Isaac Asimov and writing a limerick.

2017 Resolutions

Posted by: davidkircos in life, personal tracking 9 years, 2 months ago

2016 was the first year that I had and actually really tried to stick to any new years resolutions. I made 5 and was able to stick to 4 of them, the last uncompleted one was more of a goal and may yet be completed. I never wrote those with the intention of sharing them, but this year I am going to.

I believe an important part of picking resolutions is making sure they are defined in such a way where you can absolutely say whether they were completed or not. For example instead of something like "exercise more" I would write "run more than 500 miles tracked on Strava". Very easy to determine the success condition. So here it is, my 5 resolutions for 2017!

1. Write and publish something every day.

Success condition: Post count for 2017 on davidkircos.com is > 365 on Jan 1, 2018.

This one is going to be the hardest. Because of that, I am going to leave it the least specifically defined. This does not mean I am going to write a full blog post every day, even tweet-length posts count. As part of this, I'm going to stop automatically posting to Facebook and Twitter. I'll only share certain posts there.

2. Read 36 books.

Success condition: This Good Reads Challenge is completed.

I love reading, I have never been intentional about making it a habit. Now I am going to try. If you're wondering why 36, that is about one book every 10 days. My very rough book theme this year is "Important things we rarely think about." Which includes things along the lines of farming, history, infrastructure, how other countries governments' work, microscopic fabrication, religion, etc.

3. Music purge. Listen to (and play) all new music.

Success condition: Have my Spotify library filled with new music on Jan 1, 2018.

For the last couple years, I feel like I have been stuck in a music rut. I've been listening to mainly the same stuff over and over again, not making any effort to listen to new music. This year I'm going to try to listen to only music that I have not heard before. I've gone through Spotify and removed all my saved songs. I am relying mainly on Spotify radio and playlists to discover new content. By the end of the year, I hope to have a whole new library of music I enjoy listening to. I've been in a similar rut with music that I play on the piano. Part of this resolution is learning to play new stuff too.

4. Run a marathon.

Success condition: Complete a marathon without stopping running.

As I said after running the Detroit half-marathon, I intended to run the Athens Marathon this November. Furthest I've ever run is a half marathon, so this is the next logical step :)

5. #GiveFirst 10%.

Success condition: (breaking my own rule) this one will be mostly judged by gut.

Give 10% of my time and money to organizations which I believe will contribute to one of the 6 things measured in this graphic. If at the end of the year I feel I have slacked giving 10% of my time, I'll make up percentage points by giving more money proportionally.

Here's to a great new year!

Farewell 2016

Posted by: davidkircos in life, optimism, world 9 years, 2 months ago

There is this running joke online that the year 2016 was horrible. Sure, lots of famous people seem to have died (anecdotal) and there is a general uncertainty about the future (trump). However being an optimist, I think it's important to remember that the word is still getting better. In fact, the world is better than it has ever been.

Worldwide poverty is in a free fall.

Child mortality rates are too.

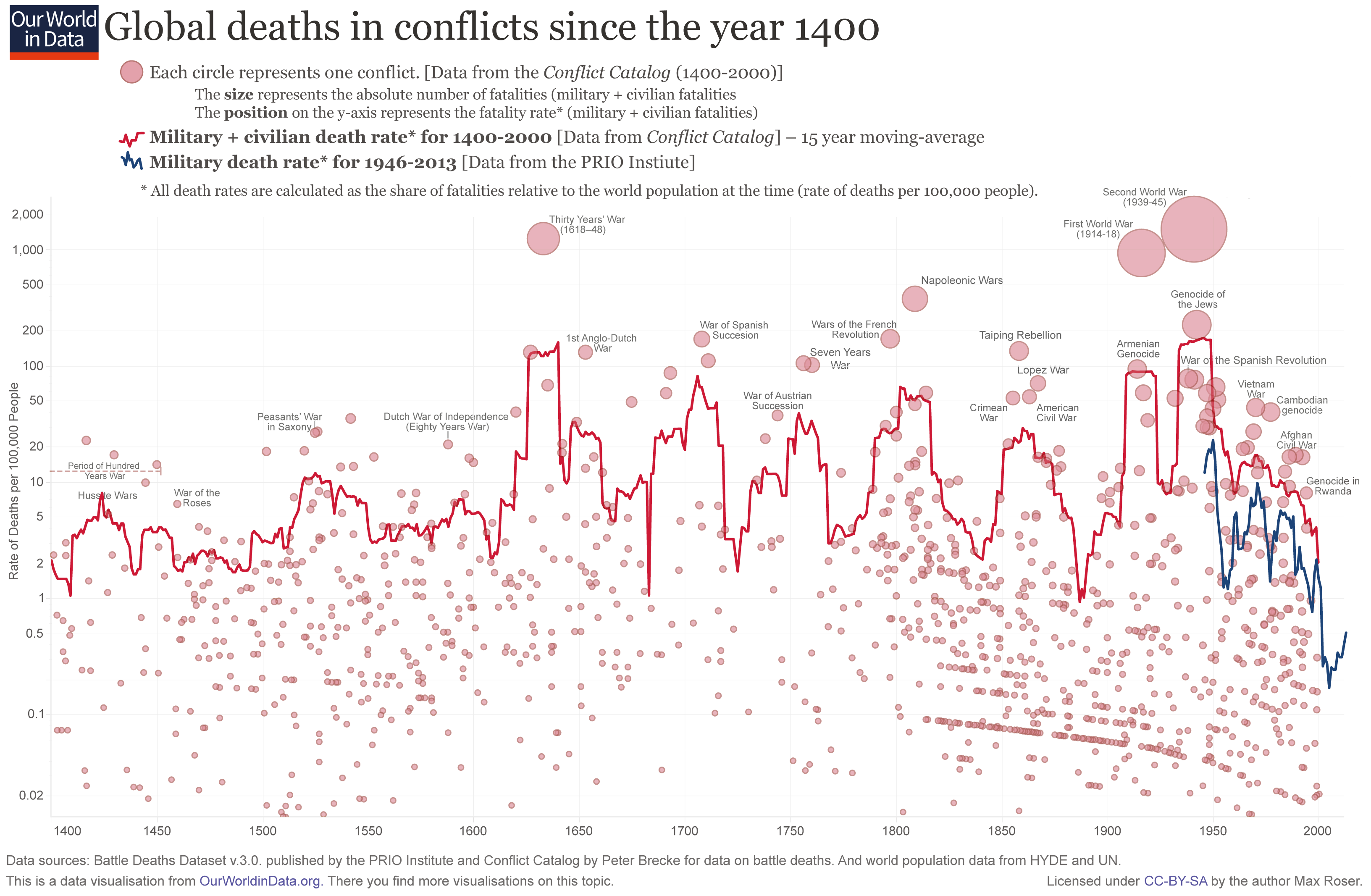

Although there is a rising global fear around terrorism, conflict-related deaths are just about as low as they have ever been.

And on a really positive note, almost half the world is online. With no sign of the progress slowing down.

Continuing on that positive note, albeit on a much smaller scale, I've personally had a great year. Of the 5 resolutions I set for myself this year, I've completed 4 of them. With the 5th hopefully being completed soon... I know mysterious. I never wrote those resolutions with the intention of sharing them. But this year I'm going to, my next post will contain my resolutions for 2017.

Happy NYE!

Note:

All the charts here are from ourworldindata.org, I highly recommend this article on their site about why most people think the world is getting worse and how they are wrong.

Techstars Holiday Gift Guide

Posted by: davidkircos in fun, startups 9 years, 2 months ago

Today Techstars published a holiday gift guide, composed of only products created by companies in the portfolio. Check it out here: http://gifts.techstars.com/

It's really cool to see all the consumer products that techstars has played a part in bringing to life, all in one place. Awesome job, Mitchell Cuevas putting the list together!

Recent Posts

- The Next Generation of Web Is Here

- End to End Testing for Expo Apps With CircleCI & Detox

- Django + Postgres Views

- Cherish Every Moment

- Skiing Into the Night

Archive

2022

- October (1)

2021

- April (2)

2020

- August (1)

2019

2018

2017

2016

Categories

- blogging (3)

- books (5)

- developer (2)

- finance (3)

- fun (8)

- life (22)

- mental health (2)

- music (1)

- optimism (3)

- outdoors (1)

- personal tracking (3)

- projects (3)

- random (18)

- running (2)

- startups (6)

- venture capital (2)

- work (7)

- world (5)

Tags

- wasm (1)

- web assembly (1)

- webgl (1)

- rust (1)

- data science (1)

- spreadsheet (1)

- quadratic (1)

Authors

- davidkircos (68)